Foodservice, The Post COVID-19 Landscape

Will foodservice still exist after COVID-19? This article bundles a series of short papers to consider the longer-term implications and impacts of COVID -19 on the foodservice industry.

Foodservice, The Post COVID-19 Landscape

Like many of you, the team at JLL Foodservice Consulting have spent much of the past 5 months on teams calls, zoom meetings and speaking at, or listening to, virtual conferences. The industry that our team comes from and the industry that we love has been one of the hardest hit in this turbulent period. We have spent time talking to Landlord Clients helping them to understand not just the potential impacts to the foodservice on their real estate assets but also some of the reasons why. We have spent time talking with foodservice operators across a huge range of markets and industries to understand, advise and often just to listen and support them. Most of the discussion up until this point has been dealing with the immediate fall out of lockdown, who will survive, how they will survive, what measures need to be taken on reopening and short term.

Whilst all of the above has been critical during this period of global lockdown, we are now starting to look further ahead. Although the immediate focus has rightly been on the here and now, I was asked a question by an Agency colleague that really rocked me and instigated a series of discussions around our team. The simple question posed was “Will foodservice still exist after COVID-19?”. To be honest, at no point had we even considered that the foodservice industry would disappear altogether, and thankfully we still don’t. But it was clear that there remains serious uncertainty around the sector, so around the table the JLL Foodservice Consulting team got together and discussed what will the future look like? We have put together this series of short papers to consider the longer-term implications and impacts of COVID -19 on the foodservice industry.

Will the Foodservice Industry Survive?

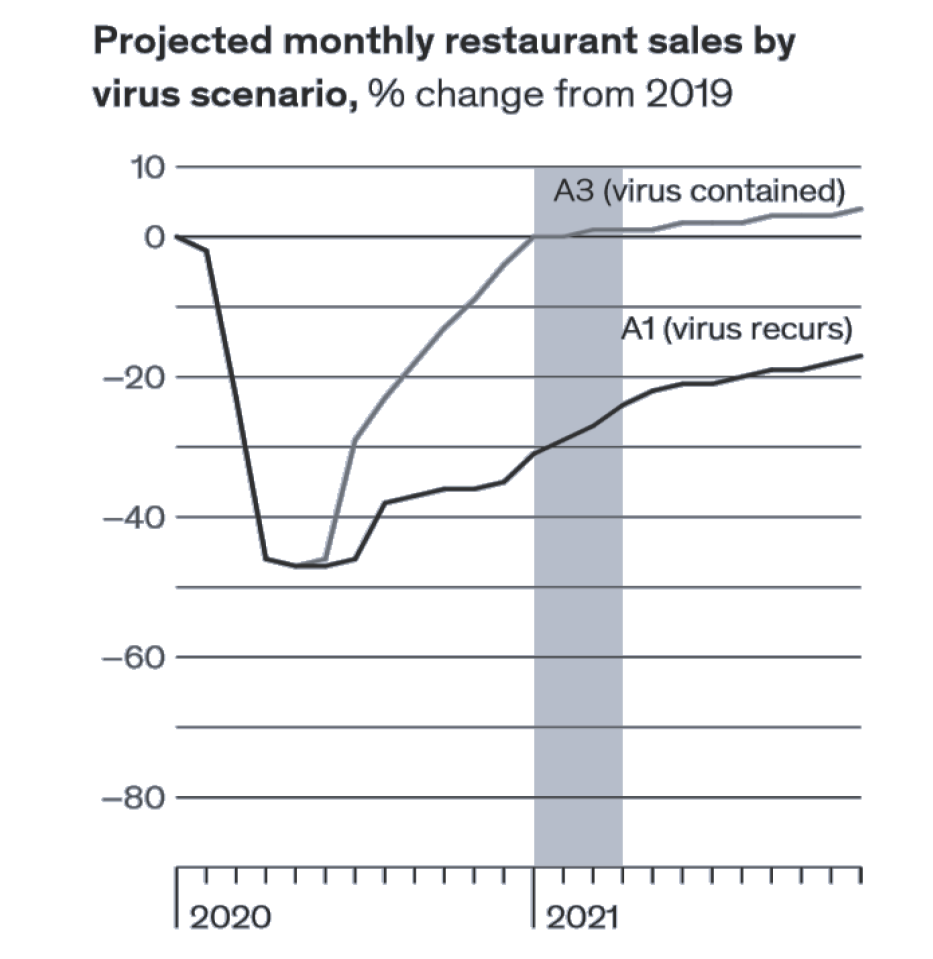

Pre COVID-19, global foodservice sales were growing at around 4% per year and this rate was expected to continue, if not increase a little further to just below 5%. In the post COVID-19 reality, global restaurant sales in 2020 are expected to be over 50% down year on year. A recent report from McKinsey & Co. suggests that, depending on the level of virus containment and local economic policy response, foodservice sales could return to pre-crisis levels in early 2021, but if containment is not as successful as hoped, then a full recovery could take a further 3 years.

In 2019, the underlying fundamentals for foodservice growth were strong with an expanding global economy, a consumer who was increasingly time poor but cash rich, a growth in urban living where space was tight meaning higher incentives to eat out, an increase in the amount of time spent outside of the home and a movement from buying things to buying experiences. All of these led to an increased ability, desire and opportunity to spend on foodservice.

Source(s): McKinsey & Co

Many of these fundamentals, consumers desire for experiences or being time poor, will remain or recover quickly. Others, like the growing trend for living and working in cities, being cash rich and the amount of time spent outside of the home may be slower to recover. But fundamentally, the foodservice industry will survive, and in the longer term will thrive. Good foodservice operators who are able to offer a quality, convenient and good value product will survive at one end of the market, whilst unique, experiential offerings will thrive at the other end. The middle ground may see more readjustment but again it will survive, because food remains a key element in our human make up. As His holiness, the Dalai Lama XIV says “We human beings are social beings. Most of our happiness arises in the context of our relationships with others”. Whilst foodservice will survive and even continue to thrive in the future, it will like many other industries be permanently changed. Over the next few pages, we will take a look into the future to see how we think these changes will manifest.

The Changing Structure of the Foodservice Industry

We have already seen significant closures across the foodservice industry, and we expect this to continue over the next 6 -12 months. Estimates vary from market to market -the NRA for example, estimates that 15% of restaurants could permanently close in the US. In Europe and the Middle East, estimates of permanent closures have been talked about around 30% and even as high as 50%.

This means that we will see a lot of foodservice space come back to the market. Much of this space will be low value, underperforming retail and leisure locations. Some of this may never revert back to being foodservice, but in reality, like in every economic downturn, shedding some of the deadwood is both inevitable and can act as a long term positive by creating a stronger and more dynamic and efficient market.

In the most prime locations, where space comes back to the market, re-leasing space should be relatively straightforward as demand will be maintained. The middle ground, the “rump” of core foodservice locations on our high streets and in our shopping centres will be hit hard in the short to medium term, but could come out of this looking stronger than ever.

An increase in space combined with slower expansion from the larger operators will create a medium-term oversupply of restaurant space. This will force a correction in what has been becoming an overinflated rental market. As ()Chris ()Miller of White Rabbit put it “Downturns are where most successful hospitality businesses are made… rents are likely to adjust down and landlords will provide more favourable terms to attract the few surviving active players in the market. Expect to see capital contributions and turnover rents to attract best-in-class operators.” (City AM)

This was supported by a recent article, from Head of Retail Valuation Advisory for EMEA, Christian Luft, who suggested that “there are clear indications of an increase in turnover rent leases being contemplated and negotiated in the UK and across Europe where traditionally this has been more commonplace.”

“Independents” Day

One of the key positives that we hope to see over the next few years is an increase in the range of quality foodservice operators on our high streets and in our shopping centres. This won’t be immediate, but independent, innovative and entrepreneurial operators will be at the heart of the recovery of the industry.

Existing, established foodservice brands are going to be focussed on survival, for many this includes the closure of a significant number of units as they rationalise their portfolio. For the short term, their expansion plans will be limited, and this, combined with a wide availability of fully fitted restaurants on the market and with landlords needing to be more flexible on their rental terms, creates an opportunity.

For the progressive landlord, who can spot opportunity and who is prepared to share risk and work in partnership, there are thousands of foodservice “brands” who have the skills, product and following ready to take those spaces. The Food Truck and Street Food boom of the past 5 years has created a ready pool of entrepreneurial foodservice businesses who would make great additions to the high street restaurant line up. Some might not be quite ready, but over the past few years we have already seen the likes Pizza Pilgrims and Vincent Vegan successfully make the move from Street Food to bricks and mortar.

The post pandemic landscape may well create a perfect storm for more to follow, seeing a rise in the range and style of offers and moving away from the ubiquitous foodservice brands who had started to dominate the foodservice market.

Food Halls

One other area that may well benefit from this is the Food Hall. There have been lots of discussions about whether the “new normal” can work for a Food Hall, and whilst it may be tough to create social distancing, this requirement cannot last forever.

The reason that Food Halls will continue to be successful is that they are a great stepping stone for Street Food and Food Truck operators to move into bricks and mortar.

Rather than having to find a quarter of half a million dollars to fit out a restaurant, new market entrants can move into a “permanent” location for a fraction of that cost by taking space in a Food Hall. We expect Food Halls to continue to grow in the medium term, as they provide the incubator for new businesses, whilst also providing a combination of great value and high quality.

Investment in Foodservice Real Estate

The JLL Global Real Estate Perspective report highlighted that, as a result of the pandemic, investor strategies have “focused on defensive, operationally-critical sectors which are aligned with secular trends. This will continue to benefit industrial, multifamily, data centres and other alternative assets.”

As one of the hardest hit sectors, hospitality investment, both in terms of direct investment and at the Real Estate level, is expected to decline, certainly in the medium term. This is unlikely to be an issue from a Real Estate perspective, as we have already highlighted, there is likely to be an oversupply of foodservice space for the foreseeable future and therefore new developments are not going to be as critical to expansion within the sector.

What will be critical is the reinvention and reimagining of existing spaces to make them attractive both to consumers and potential tenants. This will include tenant mix strategy, location planning, configuration and activation of shared spaces.

Mergers and Acquisitions

With increased pressures on operators of all sizes, we anticipate mergers and acquisitions to continue across the sector. The challenges in the industry mean that investment in the sector will provide great value. A great example of this is TowerBrook, who recently paid £109.5m for Azzurri Group, the operator of ASK Italian, Zizzi and Coco Di Mama, less than half the £250m that Bridgepoint paid for the business in 2014.

Whilst we see a growth in the number of the mergers and acquisitions within the industry, we expect to see this in the development of multiple brand portfolios. As consumers look for more experience from their foodservice visits, they will naturally move away from ubiquitous brands. The total growth potential for any brand will therefore decrease. This will lead to the development of restaurant groups with multiple brands, which will still allow for economies of scale on purchasing and central staff costs but also allow for flexibility in delivery. This is less likely to be the case in the Fast Food sector where convenience and value are the key consumer drivers.

Foodservice Categories

As a general rule, when there is economic difficulty then customers tend to trade down in terms of their foodservice choices, rather than cut them out altogether. So, someone who would normally use Fine Dining, may trade down to Casual Dining and someone who normally chooses Casual Dining may trade down to Fast Casual. This is why operators who are known for their value offering, such as Greggs in the UK, or McDonald’s globally, have often maintained robust sales during economic downturns. This is something that we expect to see again post COVID-19, but given the unique and global nature of this downturn, there will be some other, less obvious impacts.

We expect there to be an immediate impact on the number of Coffee Shops that have proliferated, particularly on our commuter routes. As people commute less regularly, there won’t be a requirement from the big brands to have a store on every street corner. In city centres, formats like Starbucks “pick up” points could well become more common place. In the US, Starbucks are replacing 400 stores with 300 pick up only locations already. Conversely, some of these will be replaced by an increase of larger stores in more provincial locations, as people work from home and use their local coffee house as a work, meeting, third space.

Fine Dining is likely to be the least affected in terms of its ability to operate to their usual capacity as social distancing in the front of house areas will be easier to maintain due to their low seating densities. However, due to the high proportion of Fine Dining located in cities, we expect a number of casualties in these areas, particularly from those located near, and supported by, office populations. Those in premium residential areas are less likely to be impacted.

In Casual Dining, one of the Corona Virus impacts has been simply to bring forward challenges that were already there. Marginal sites that were breaking even or just making a small profit have been shown up for the marginal and “weak” businesses that they were. The UK in particular had seen a rash of CVA’s whereby operators like Pizza Express and Itsu had been able to reduce rents across their portfolio, even dumping underperforming units. This has continued through the pandemic.

The pressure on the Casual Dining restaurant market is a result of the “space race” of the late noughties where equity backed brands over stretched themselves in terms of their expansion, paying over the odds for rents in premium locations, or expanding into locations that would not support their concept. One way that Casual Dining operators will look to extend their menu offerings will be to create All Day Dining opportunities that fill the midmorning and afternoon shoulder periods to drive additional revenues.

Conversely, with its value led offering, Fast Food will continue to trade well through an economic downturn, as people trade down and the big brands will look to increase the integration of technology into their operations in order to maintain a competitive pricing position by reducing costs and increasing throughput.

There will be a higher number of causalities in the Fast Casual sector, not because it won’t remain popular, but because it is one of the least mature markets, and therefore many of these concepts are smaller businesses who simply won’t have the cashflow to survive the downturn. However, as a category, we expect it to perform well by hitting a sweet spot of consumer perception of being both good quality and good value.

Social Drinking has been hit particularly hard and, in many areas, it will continue to struggle. Drinking is often a pre or post activity, and those bars reliant on offices and major events locations will struggle to come back as quickly as other locations as footfall in these areas will be slow to return.

Whilst there will be winners and losers across all foodservice categories, it is clear that some sectors will perform better than others.

Foodservice Prices

Whilst it might be counterintuitive as consumers will generally have less cash than pre-pandemic, in our view, across the longer term, the price of eating out is set to rise as a result of increased costs created or exacerbated by COVID-19.

survey

survey

carried out by trade body UK Hospitality

carried out by trade body UK Hospitality

The first and most obvious cost, will be the cost of borrowing / investment that a lot of operators have had to take on to survive the pandemic. In the UK, a found that nearly half of all hospitality businesses have applied for a government Business Interruption loan. Whilst this will have helped many survive, it creates an extra pressure moving forward.

Food prices are also expected to increase as a result of COVID-19. This happened in the financial crash of 2008 and was exacerbated by different countries introducing restrictions on exports. Whilst this hasn’t happened yet, if there’s greater competition globally for food and, if as expected we start to move to more localised production, then prices will likely rise.

Staffing costs are likely to increase as a more rigorous cleaning schedule is implemented, and labour-saving operational tactics like buffets, self-serve drinks and condiment stations are binned due to increased awareness of cross contamination.

The impact of this will be twofold. With three of a foodservice business’ biggest cost lines seeing increases, they will naturally look to balance this from other areas. Foodservice is a tight margin business and margins have only been getting thinner as the competitive landscape got harder.

As we have highlighted earlier, with decreasing demand, there will be pressure on rents and operators will make the most of this, however this won’t be the only solution. The other change that we expect to see is an increase in prices.

Now there is an argument that consumers have had it “too good for too long” in terms of prices. In reality we should all be questioning how a beef burger can be grown, raised, slaughtered, transported, cooked and served at a profit for just £0.99. Prices have been kept low in foodservice due to competition and mass production, but as people start to look more into how their food is produced, and quality becomes as important as price, then we anticipate prices to move up, to accommodate both increased costs and to meet customer expectations in terms of quality.

Foodservice has lived on the thinnest of margins for too long. The impact of COVID-19 has shaken the industry and highlighted to many that a more robust business model is needed, price increases will be one element of creating a more sustainable sector. This will be particularly relevant as Governments begin to withdraw lockdown specific support.

Shifting demand

One area where we believe all foodservice operators and landlords could use pricing better in the future, is to better utilise discounting in order to shift demand to traditionally quieter periods earlier in the week.

The Eat Out to Help Out government supported scheme in the UK, offered a discount for using foodservice from Monday to Wednesday. Over 27% of the population used it within the first 5 days and over the full month more than 64 million meals were served under the scheme.

High streets, shopping centres, shops, restaurants and cinemas are all busiest at the weekend, because that is when people have time off. With flexible working becoming more popular, the most astute landlords and operators will work together to shift demand to quieter periods, allowing them to sweat the asset better across the trading week and maximise revenues at peak times.

Location, Location, Location

During lockdown, many businesses switched to a significant level of working from home. Whilst many of us are keen to get back to the office, social distancing is going to continue to impact office capacities for the foreseeable future. Where working from home has been a success, businesses will only naturally review their office space needs, resulting in fewer potential foodservice customers in traditional business districts and on traditional commuter routes.

Many city centre restaurants get a mix of guests from customers coming to work and those coming from home or for leisure. That is going to need to be reconsidered. Fundamentally there will be a lower requirement for foodservice in and around key office and transport hubs. This will cut across all categories. No longer will the coffee giants need a unit on every corner of the CBD, and there will be a need for fewer bars and restaurants too.

One other challenge for cities, particularly historic cities, is that many of the units, and even some streets are so small and narrow that, for foodservice under social distancing, they are completely unviable. There are any number of traditional British Pubs in London and brasseries or bars in Paris or Rome, that are so small and tucked down such narrow side streets that they were just not able to function during the pandemic. This will make them much less attractive propositions in the longer term as operators look for pandemic proof real estate.

Conversely to this reduction in Central Business Districts (CBD) locations, foodservice operators will likely seek locations closer to residential areas if office populations do permanently decline. In many ways the impact is likely to create a “shift” in spend rather than an overall reduction. Guests capacity and propensity to spend on foodservice should theoretically not change, it is just that the location will change. Foodservice will need to relocate to where people are, this will make the suburban areas of cities, the residential and leisure quarters more attractive to foodservice operators in the longer term.

Cities will still thrive, even if working from home continues at a high level, it’s not just jobs that drives us into cities. Eating out, a diversity of culture, the arts, finding a partner. All of these things make city living what it was and will continue to do so, it’s just that a preferred location for a foodservice operator in Paris might be a residential area like Reuilly or Montmartre rather than the CBD at La Défense.

Leisure led locations, such as Shopping and Entertainment districts will, in the long-term, bounce back better than their business counterparts. Shopping and entertainment are social activities and things that people want to get back to. As much as getting back to the office is important, many people will be reducing the number of days they will be in their office to save on travel times and costs. The most attractive locations for foodservice will be areas with mixed uses, areas that create footfall all day and all week allow for restaurants to maximise revenues.

Design

COVID-19 saw a lot of very quick and very innovative responses to the need to create distance and separation between staff and customers in foodservice environments. From the plexiglass screens at counters and between tables, to floor signage indicating distances, operators did whatever they could to make spaces safer. In this section we are looking at what more permanent design trends might impact the foodservice industry.

Prior to COVID-19 there had been a trend for operators taking smaller units in order to minimise rental costs. These smaller units became a challenge with Social Distancing, and city centre micro units may become less appealing to foodservice operators for long term leases as a result.

We continue to see demand for locations that accommodate drive-thru windows and curb-side pickup lanes. With the likes of “Chipotlanes” combining drive thru units with tech-based ordering, there is potential for a new market of operators to look at this type of real estate, as technology opens up drive-thru possibilities even to those concepts that offer product personalisation, expanding their popularity from the traditional fast food options.

Units with outside spaces proved to be the quickest to come back to business and the availability of outside spaces will become increasingly important to operators looking at potential sites in the future. However outside spaces become redundant in bad weather. We expect operators and landlords to work together to create semipermanent inside outside spaces that can flex quickly and easily to suit the weather.

With the increases in delivery expected to continue post COVID-19, new restaurants will need to be built to support delivery services. This will mean units with rear access and larger kitchens and shopping centres built with easy access for delivery drivers.

Diversification

Many foodservice operators have diversified during the lockdown period, turning to delivery but also to meal kits or even direct grocery supplies.

The decision to continue with delivery for most will be a straightforward one as it already sits within their business model. Interestingly though, some are also planning to continue with the provision of meal kits such as Patty & Bun in London or Roberta’s in New York.

How these sales should be captured going forward on a turnover rent basis will need to be considered by both landlords and Operators. Whilst landlords may feel that deliveries or meal kit orders prepared and fulfilled from units on their estate should be captured in any turnover figure for turnover rent charges, with delivery aggregators charging up to 30% commission, this would leave very little room for a profit. How this plays out will be key to how attractive a unit may be to an operator in the future.

If landlords are too draconian in their demand for a slice of the delivery pie, then many operators will just shift their delivery business elsewhere.

Dark Kitchens, a New Dawn

Before the COVID-19 crisis, the food delivery market was growing at a rapid pace throughout Europe, with the UK at the forefront of growth. The UK foodservice delivery market was worth approximately £8bn at the end of 2019 (up 13.4% on the previous year) and was expected to grow 21% by 2021 to reach £9.8bn. In comparison, the UK eating out market reached annual sales of £88bn, with predicted growth to £96.5bn by 2022, so eating out was still very much at the forefront of guest choice until the global pandemic struck.

The expansion of the food delivery sector at the time was being driven by the insatiable appetite of the millennial market and the convenience that restaurant quality food delivery brought to the time pressured consumer. A longer-term trend was the increasing shift to urban living which is forecast to put increased pressure on city living accommodation. In 2017, 54% of the global population lived in urban environments and this is expected to increase to 70% by 2050. As more space efficient housing is built to meet this demand, it’s the social spaces of new homes, particularly the kitchen areas, that are reduced in size, driving the need for both eating out and eating ‘in’. Just look at Hong Kong’s vertical living as a precursor to future city centre living.

Hand in hand with this growth has been the emergence of ‘dark’ or ‘ghost’ kitchens – purpose-built facilities where restaurant quality food is prepared and delivered from. It is estimated that there are in excess of 700 dark kitchens in the UK, but this is dwarfed by the estimated 7,500+ units in China according to Euromonitor. Indeed, the growth of the market, according to the same source, is forecast to reach €1 trillion by 2030 on a global basis.

The COVID-19 crisis has seen many facets of the hospitality industry accelerate proposed future plans, predominantly around the technology and delivery areas. With lockdown and zero income for most tenants, some operators saw the opportunity to pivot their operations as a way of navigating through the crisis and at least covering costs.

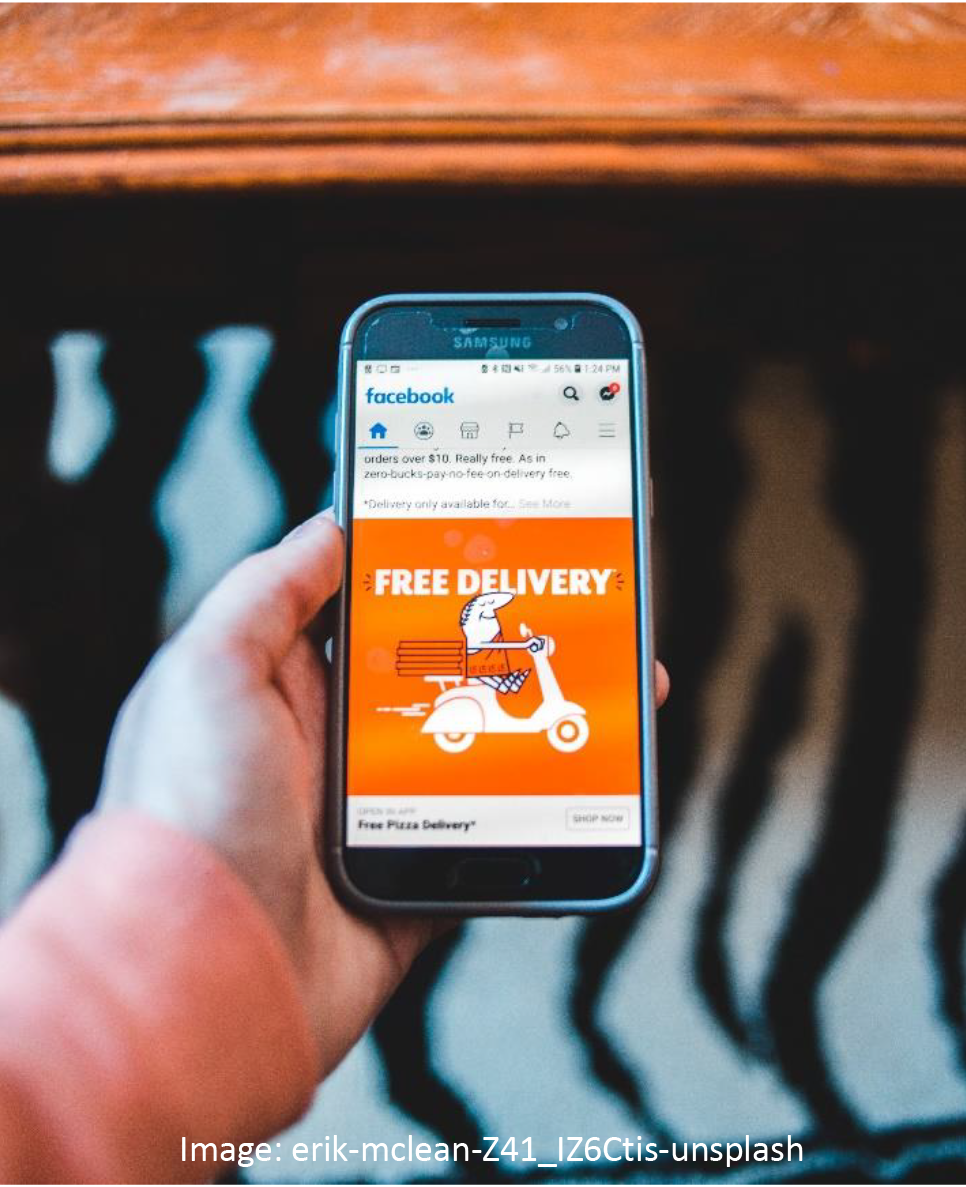

Food delivery was at the forefront of this re-engineering and, with some aggregators waiving signing on fees to their platforms, delivery sales surged, through a combination of unit produced or dark kitchen produced offers.

Despite the costly measures put in place by operators once sectors of the hospitality industry began to open, consumer confidence of how ‘safe’ dining in was, was at the forefront of guest demand. There has been a real step change in the use of food delivery – no longer is it the sole bastion of the millennial market – as lockdown of restaurants and long queues at supermarkets were a given, new user groups in the form of families and silver surfers saw food delivery as an acceptable part of the weekly dining regime. The ‘safety’ of no contact and low contact food ordering was a pivotal factor in the growth of online food sales and it’s a disruptor to the traditional ‘dine in’ market that is here to stay.

We are already seeing more high street, ‘bricks and mortar’ brands opening their own dark kitchens, either to sell the ‘mother ship’ menu items, or through the development of virtual brands. Operators soon realised that if guests couldn’t go to them, new routes to market had to be developed to get the food directly to customers.

So how does it work and what’s in it for the operators?

In the UK, Deliveroo Editions, for example, operates about 16 sites, providing the workspace for foodservice operators to prepare and cook food for delivery only. Each Editions kitchen typically hosts between 6 and 12 tenants, a combination of branded high street players and ‘local heroes’. There is no rent, no business rates and no utility bills for the foodservice operators to pay, instead each tenant pays a % commission on each order to Deliveroo, who also provide the riders and drivers to deliver the food. Deliveroo, as the aggregator, provide the platform and the transport infrastructure, leaving the tenants to focus purely on food production.

Alternative models, such as Foodstars, where kitchen space is leased to operators on an all-inclusive rent, benefits the operator as both rent and labour costs are less expensive than the traditional ‘bricks and mortar’ model – although factor in that the aggregator slice of sales still needs to be paid.

The rent for dark kitchens is typically much lower than for restaurants, as they are located in tertiary areas such as industrial estates or car parks that are close to the catchment areas that they service rather than in the high footfall location required for a restaurant.

The advantages to operators are clear – there is no tenant capital investment and write down of investment associated with a physical store. In conjunction with this, there is a reduced labour cost as there are no guests and therefore no front of house staff/ wash up staff, etc. It provides tenants with the ability to test the water in new markets where the brand is underrepresented, without having the risk associated with opening a full restaurant. Finally, the short-term nature of taking space means tenants can exit without onerous costs.

There are some disadvantages however. Spoilt food (spillages, temperature loss, etc) during transportation can damage brand reputation, as can poor social media reviews. Fundamentally, food delivery will never be able to provide the experience that a bricks and mortar unit can generate, with staff/ guest interaction, the tactility of the dining experience and the social aspects. Guests are also less likely to purchase the ‘add on’ food and drink items (breads, aperitifs, dessert, coffees, etc) when ordering online, so average spends are lower than in a restaurant environment.

So, are dark kitchens a threat? Or are they a new asset class? The reality is, it’s a balance between bricks and mortar units and food delivery. The bricks and mortar restaurant will always provide the experience, the ‘showcase’ for the brand – the delivery will provide the incremental revenue and meet the needs of the time pressured, and increasingly safety savvy, consumer.

Workplace Foodservice – time to reboot?

Here we are in September 2020 and a significant proportion of staff restaurants and canteens still remain closed or operating with a skeleton offer.

Unlike their high street colleagues, who have been able to get back to some level of business through the use of outdoor spaces and government initiatives, workplace restaurants are reliant on the workforces that they serve. With 50 of the biggest UK employers1 saying they have no plans to return all staff to the office full time in the near future, the outlook for workplace foodservice certainly in the medium term looks challenging.

So far, the majority of clients and contractors spoken to have confirmed that their facilities have been mothballed over lockdown with the majority of staff furloughed. Some elements, coffee bars etc are now being brought back online as population levels edge towards the 15-20% of pre-COVID-19 levels. Clients in the main have been supportive of their Contractors and borne the fixed costs associated with their specific agreements. However, the ending of the UK government’s furlough scheme on the 31st October will surely be a catalyst to structural change for the sector.

With no structured return to offices in the foreseeable future and many businesses reporting that they are unlikely to ever return to pre-pandemic population levels, the spectre of mass redundancy looms. Few Clients will be willing or able to support catering labour costs with little or no revenue to offset it and contractors will have no alternative but to cut their cloth accordingly, accelerating permanent sector change.

Unpalatable as it may be, COVID-19 is going to permanently change the working lives of millions, potentially directly impacting on the livelihoods a goodly chunk of contract catering staff. Even if a vaccine is developed, we have all learned that we don’t need to be in an office all the time, with Teams, Zoom and other platforms completely replacing face to face meetings during lockdown. The Foodservice requirements in offices in the future are likely to be different.

Short term Solutions

In the short term, Contractors have been proactive and quick to reassure Clients and populations by delivering COVID-19 safe workplace solutions, typically seeing a complete suspension of self-serve and a switch to served food alongside beefed up pre-packaged ‘grab & go’. Others are planning to make more use of CPU facilities where food production can be more closely controlled, limiting the number of touch points. Several Clients have reported double digit increases in lunchtime uptakes since lockdown, albeit off a much lower population base.

Whilst an immediate solution to providing COVID-19 safe foodservice, this packaged solution rails against all the initiatives that many have taken on sustainability and packaging, and detracts from the concept of delivering experience, provenance and authenticity. If this is as good as it gets, then surely lunchtime uptakes will dwindle.

Image: @ andrea-davis-yLX5NwdeRKM-unsplash

So, what of the longer term?

The pandemic has presented a once in a lifetime opportunity for Clients and Contractors to re-think the model and break the mould. Businesses with vast legacy staff restaurants, big on labour, menu range and merchandise space, have the opportunity to press re-set, delivering fit for purpose and future-proofed foodservice offers or even no fixed foodservice at all.

There will never be a better time to streamline menus, recalibrate prices and service operations. Employees who once boycotted canteens over 5p increases in toast prices, or the removal of chips are now much less likely to complain as we emerge from COVID-19, perhaps more understanding of the impact on all businesses and working lives.

Long before COVID-19 we were designing and delivering smaller restaurant footprints, moving away from providing a seat for the majority of staff, to a model that reflected increased competition from the High Street, the incidence of staff bringing in their own food, reckoned to be up to 40%2 in some businesses, and a general move away from the traditional ‘meat and two veg’ main meal option, much more towards lighter, more portable lunch options.

With the reality that we are unlikely to see a return to pre-COVID-19 population levels, even with a vaccine, the demand for foodservice space is likely to reduce still further. This, coupled with a likely spike in workers bringing food from home as they have become accustomed to it over lockdown, will only add to this reduction.

Other external variables are also likely to shape the future of workplace foodservice: Sector disruptors City Pantry, Foodr, Grazing Food, etc, were on the rise pre-pandemic, adding a tantalizing alternative to the traditional contract model. Suddenly employers are going to be able to tailor their F&B offering to their post-COVID-19 populations – focussing lunch services on certain weekdays only, capitalising on periods of peak office usage, with minimal cost on other days.

This isn’t the end for staff restaurants, they will still have a place, it’s just that they are going to look a little different – perhaps open for longer to service staggered work patterns, more flexible to accommodate peaks and dips in populations, sharing space with co-working and break out spaces, and perhaps evolving to include more pre-order / pickup or delivery.

Whilst no one can say exactly what the future will look like for foodservice in offices, or indeed anywhere, working populations will still need to eat, whether that is at home, in the office or in a contemporary flex collaboration zone! The challenge for contractors and clients will be to flex their offerings to maximise use and mitigate cost.

We have been working with occupiers, landlords, caterers and architects for over 20 years to develop foodservice offers that best meet the needs of users and this collaborative approach will continue to deliver the best possible solutions.

The Impact on Sustainability

In 2018, the National Restaurant Association highlighted environmental sustainability as one of the top menu trends and in 2019 Starbucks announced that they would eliminate one billion straws each year. The sustainability movement was gaining real traction across industries due to increasing consumer demand, legislative pressure and increased media focus on the impact we were having on the planet. Then came COVID-19.

In many people’s opinions sustainability remains the bigger crisis in the long term, humans lose focus easily and the impact of COVID-19 has been understandably all-consuming. Unsurprisingly, in early April, the NPD Group reported that “consumers were trading sustainability for safety and cost”. Whilst some companies managed to continue to operate in a sustainable way, too many had to make unwanted compromises and resort to plastic packaging in order to survive.

We as consumers share the blame having created a big (food) waste problem. According to figures from Nielson, “UK shoppers bought an extra £1.9bn of groceries and personal goods in the four weeks ending March 21”. In the following weeks, social media was then filled with images of overflowing bins! COVID-19 is believed to have increased the yearly amount of food waste in the UK from 30% to 40%, a loss valued at £30bn. Brewers were preparing to pour away 50 million pints of beer and farmers were left with a 190,000-tonne backlog of potatoes, as chip shops and fast food restaurants closed. (inews)

However, as much as environmental initiatives were hit early on, throughout the pandemic we also saw the sustainability movement thrive. Again, social media was filled with examples of innovation from of a sustainable approach being taken to sourcing, social conscience and the environment. Examples include pub managers 3D printing PPE for the NHS, restaurants donating excess food stock to charities & key workers or creating partnerships with their suppliers to support them through the crisis, and spirit makers switching production to pure alcohol for use in hospitals. People loved it and said they hoped that these kinds of behaviours would continue, even after the crisis.

Midway through the pandemic, calls for a refocussing on the agenda gradually increased and were magnified by announcements from multinational firms such as Dunkin Donuts announcing a switch to plastic-free cups as well as plans to double the number of green restaurants. Over 150 global corporations urged world leaders to aim for a net-zero recovery from COVID-19. The lockdown has shown us what is possible, not only in terms of community outreach, but also in terms of reducing greenhouse gas emissions (through the temporary shutdown of transport and industry).

In June 2020, a study by McKinsey found that despite significant financial concerns, consumers have started caring more about sustainable products, types of packaging, and how companies treat their employees. All of these are aspects that heavily impact the foodservice industry, especially as to-go concepts are on the rise. Further, this study is an indication that the sustainability trend is here to stay because if we do not stray from it in times of distress, we will do so even less when things improve again.

Overall, landlords and operators will need to incorporate sustainability into their businesses in a meaningful way if they want to engage and retain customers and we have listed below some of the longterm sustainability trends (none new, but all magnified) which we expect to see more of as a result:

Health-awareness

The pandemic increased health awareness and people have become more immuno-aware. Customers are more curious than ever about the health benefits of certain foods and want to know if what they eat is good for them and the planet. As a result, the plant-based movement is expected to boom even more than expected, with one study forecasting “a grow of the plant-based market at a CAGR of 11.9% from 2020 to 2027 to reach $74.2 billion by 2027” (Source: Meticulous Research). As more operators incorporate these products on their menu or develop concepts around it, landlords will need to ensure the concepts are part of their on-site foodservice mix.

Eco Friendly Design

In July, McDonald’s completed its first net zero energy restaurant, which creates 100% of its energy needs on site. Expect to see more of this from other foodservice operators as they look to reduce the environmental impact of their portfolio. Landlords need to be ready for this as it will change construction practices and investment and may also require older assets to undergo eco-refurbishments to remain attractive to eco-conscious tenants.

Community Outreach

As mentioned earlier, people started paying attention to how companies treat their employees and how we treat each other. As a result, we expect to see an increase in community outreach ventures. Whilst foodservice operators will increase and improve their charitable activities, landlords may start to reconsider who they are associated with. Who serves the coffee in your HQ lobby? Is it an international for-profit brand or a social enterprise that employs homeless people? Are they paying their staff a reasonable, fair and living wage?

Sourcing

The pandemic has shone a bright light on existing supply chain issues and the foodservice industry is no exception. For landlords this might mean providing space for initiatives such as the world’s largest urban farm atop a convention centre in Paris, on which farmers are using a soil-free approach to agriculture that uses less space and fewer resources. Going down another route, New York based Just Salad announced that they will roll out carbon-labelling across their 38 sites this September to raise awareness amongst their customers, in an effort to reduce the 26% of global carbon emissions which are produced by food production. Consumer food giant Unilever will follow by doing the same on all of their 70,000 products.

Packaging material & disposables

Whilst it was one of the strongest hit environmental initiatives it is also one that operators and governments are most ready for and we expect this to come back with a bang. Operators will be battling each other to announce the best new initiative whilst landlords will be expected to enforce that their tenants adopt eco-friendly packaging strategies by eliminating single-use plastic or switching to more sustainable materials. Landlords will also need to ensure that their assets are equipped for new types of waste as separating waste and composting of organic matter becomes the norm rather than the exception.

The initial hit on environmental targets was (in part) due to the urgency at the start of the pandemic, but now as the immediate crisis is over and we move into longer term recovery, evidently more and more companies are switching (back) to more sustainable operational solutions. If anything, the crisis has highlighted some serious global problems with how we live our lives. People recognise that now is a unique opportunity to reset not to the status quo but to a healthier, smarter system. The sustainability trend has been accelerated by the pandemic and all indicators suggest that this trend is only becoming more important and we could not be happier to hear that!

Technology is Zoom-ing Forward

For many years the foodservice industry saw the ‘tech revolution’ as something that happened to others. All you needed was a pen, pad and a member of staff and you have a restaurant ordering system. In the kitchen all that was required was a cooker and a chef and someone to wash up. Up until recently many independent restaurants and bars had very little in addition to this. Sure, the brands installed intelligent monitoring and EPoS systems but essentially the industry was moving forward slowly on the technology front.

Technology in the industry was focussed on streamlining the journey of the order to the kitchen and its production using minimal ingredients, staff and energy, thus increasing profitability. The fast food brands widened this range, realising that their best ‘customer service’ was to get the order from, and the food to, the customers as quickly as possible, wherever they were, even if this meant minimal ‘hospitality’ in terms of human interaction. This drove technological advances in touchscreen ordering at one end of the journey and delivery systems at the other in the form of drones and drive thrus. Then COVID-19 arrived and the whole industry appeared to grind to a halt within weeks. Only it didn’t have to, as people still wanted to eat and didn’t always want to cook, it was just a matter of how to facilitate them doing so.

Opportunity and disruption are the main drivers for technological advances. The fast food (and some fast casual and casual dining) operators were ready with their delivery logistics and their dark kitchens. The rest of the industry had to catch up or, at least, be ready to take maximum revenue as soon as was possible to do so.

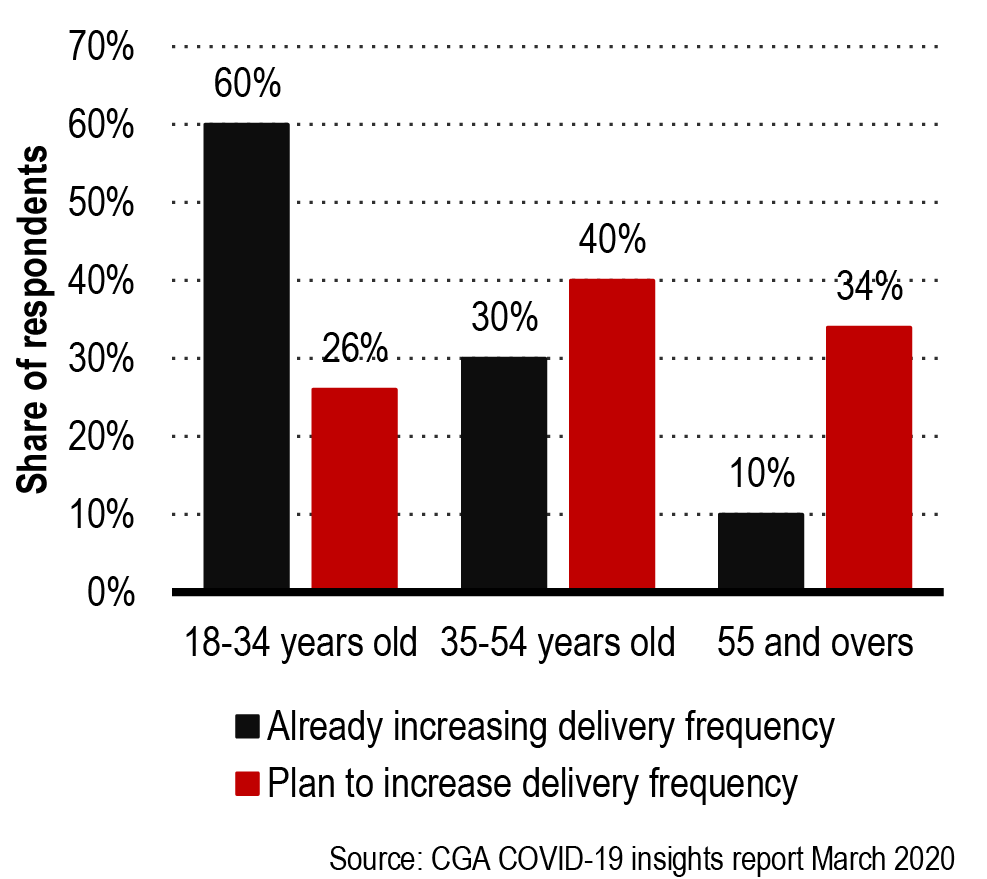

Delivery App-cceptability

The uptake of people aged 35+ using delivery (for retail goods as well as foodservice) has increased dramatically. The pandemic has forced the older ‘technophobes’ either by choice or necessity to try delivery. According to a CGA COVID-19 insights report from March 2020, even at the beginning of the pandemic, the two age groups of 35+ had already increased their takeaway delivery frequency and a large number were intending to do so.

The ease and simplicity of using apps and on-line ordering systems have assisted this move with many elderly people being forced to use apps for grocery supplies and then realising it is not quite the ‘work of the devil’ and that there are many things that can be ordered in the same manner.

What has helped more than anything is the availability of delivery for a wider range of foodservice (casual and finer dining for example) which appeals to a demographic who were not using the service before. The Michelin Guide website now offers a list of ‘Restaurants Offering Takeaway & Delivery’. According to the list there are 35 Michelin starred restaurants across the UK (13 of which are in London) now offering this service.

However, it is estimated that only 13% of eat out meals have been replaced by deliveries so, although every little helps, it is not and will not be the complete saviour of the industry. Interestingly, the different age groups use deliveries in different ways with the over 35’s more likely to sit round the table and have a social occasion (as they would in an eat-in environment), and the younger audience are much more likely to watch tv or even be on their own whilst consuming the delivery.

Robots and Drones

In our 2020 Foodservice Trends book, we looked at the rise of ‘robot chefs’ and automation in the kitchen and counter environment. The IFR (International Federation of Robotics) predicted that there would be around 630,000 robots in the worldwide foodservice industry in 2021, up from 60,000 in 2009, which is certainly a big increase.

The actual number of restaurants, bars and pubs worldwide is a difficult number to get to, but it is certainly in the 10’s of millions and taken into context, the number of robots is relatively small. However, the technology was there, being upgraded, in operation and proving its value before the pandemic. Although we have not seen any specific examples or stats yet, it is safe to assume that many worldwide operators, especially in the fast food sectors, are scrutinising this tech in even greater (and more serious) detail than 6 months ago. The repetitive and standardised nature of much fast food cooking is ideal for robotic tech and the advancement and accuracy of heat sensing equipment means that cooking even high-risk products is now a reality. The pandemic is potentially the disrupter to fully kick start the use of this tech.

The use of drones (and delivery ‘bots’) for customer (and supply chain) delivery has been talked about for as many years as drones have been around. This tech has even more hurdles to climb than the operational robots for obvious security (for both the product and the drone), health and safety and expense reasons. Digital prototypes manufacturer Protolabs conducted a survey in March and April 2020, involving 325 aerospace innovators and leaders from across Europe to understand the movement during lockdown. The report indicates an increased appetite for ‘low space’ innovation and investment into fast-track testing of robots and drones (up from 11% to 53%). Whilst this is drones in general, not just in the foodservice industry, the obvious driver from delivery companies such as Amazon, along with the need to deliver Covid-19 test kits to remote places, will mean that this tech is going to improve fast, reduce in cost and therefore filter more quickly into the delivery of takeaway meals.

(Don’t) Touchscreen Ordering

McDonald’s invested over $1B last year in the kiosk touchscreen format to help streamline their ordering system. Due to the pandemic, some of these systems have been redundant for many months but others have created a simple and “safer” service process which minimises contact between staff and the customer. On the negative side however, they also create massive high-volume touch points, which potentially create a risk of guest to guest cross contamination. We expect that alternative “no touch” solutions will be preferred in the longer term and there may be a clue as to what this might be from the traditional British Pub.

British Pubs faced a couple of issues, firstly they were asked to track all guests and secondly they were required to end the fun(!) melee of bar service. This presented a major change in operations but one that could be fixed easily and relatively cheaply by adopting simple app technology where the guests register (via a QR code scan) their details (covering the track issue) and credit card and then gain access to the whole menu. Coupled with knowing the table number, a very efficient and simple delivery service was created. Of course, this is not new tech as ordering apps have been around for a long time. However, its adoption in more traditional environments was progressing very slowly. The pandemic disrupter has pushed this forward and made it the norm for the moment. We believe that this is one pandemic-led adoption that will become a permanent change given that the general consensus is that the new system is more efficient (for both guests and operators) than the previous one. However please spare a thought for the bar staff who now have no one to talk to apart from 2 or 3 colleagues and a printer!

The key to any of these changes being permanent is the cost and ease of adoption. Robots and drones are currently expensive with risks attached as the tech is relatively new meaning small, albeit significant uptake. The real winner has been the existing tech. The delivery and ordering apps and the EPoS systems have shone through and as demand has risen, the cost has gone down. The dam has broken, and many foodservice operations have bucked a tradition they never thought they would. In a pad and paper world, the ordering app is now king.

Conclusion

Fundamentally, like almost every other industry we still cannot accurately predict the full extent of the impact of COVID-19, however we are confident that the foodservice industry will come through it, it might be battered and bruised, but the future of foodservice being a fundamental part of your future real estate development remains unquestionable.

The question for developers, landlords and investors alike will be the same question that JLL Foodservice Consulting have been answering for our global clients for over 25 years now:

- How much foodservice capacity do we have?

- What type of foodservice is right for our customers?

- How can we increase our foodservice uptake?

- What is a sustainable rent for the tenants?

Getting these questions right and developing a sustainable foodservice strategy for your real estate asset is more critical than ever.

For the past 5 years, particularly in the retail sector foodservice has been used by Landlords as an easy space filler. Some developments were at, or close to over providing foodservice space in comparison to their available footfall and spend. Private Equity backed foodservice brands were competing on rents to take the space left empty by struggling retailers leading to far more restaurants than originally planned in any given development. Rents were on the increase and margins were getting squeezed. The market was changing.

In April 2018, in the JLL Foodservice Consulting blog, Associate Director Ken Higman wrote, “As the retail and restaurant property landscape rapidly shifts, landlords and tenants will find a better balance. At the end of the day, it is in both parties’ interest for consumers to eat out more, which means establishing a rent level than enables restaurants to charge ‘affordable’ prices. In the short-term, we foresee a healthy turnover of tired concepts as the property market holds out, and then a boom of innovation as a new wave of brands swoop into vacated, rent-adjusted units. Timing may well be everything.”

Like many other things, COVID-19 has put a rocket under what was a “healthy turnover” of tired foodservice concepts and has turned it into a conveyor belt at warp speed, but this will create an opportunity for the most forward-thinking landlords to work with more experimental, socially responsible and original foodservice brands. To create a foodservice strategy that understands what their customers want from foodservice, that recognises the value of the “halo” it can create, a strategy that recognises that a strong set of foodservice tenants can deliver not only in terms of maximising foodservice rent, but also driving footfall, dwell times, retail spends and, where applicable, surrounding real estate value.

Foodservice can, and will, continue to act as a great footfall attractor if delivered correctly but overproviding the same old brands in boring spaces will no longer cut the mustard and creating a foodservice ghost town is not going to deliver the differentiation, excitement and engagement that a high street, shopping centre or leisure space needs.

The proof of the pudding, as always, will be in the eating.

About JLL Foodservice Consulting

We are a dedicated Foodservice Consultant Team who have worked across almost every international market over the last 25 years. Using JLL’s network of offices and local teams, we can utilise local experience wherever we work and have employed a diverse mix of people, most with direct F&B operational experience.

Our work covers the full spectrum of foodservice, from shopping centres, urban regenerations and iconic hotels to world class stadiums, further education and blue chip office buildings and everywhere in between. With over 80 years of foodservice consultancy and 40 years operational experience at Director level, we know first-hand, that no two developments are the same and bespoke each brief to your project and aspirations. We know what customers and operators want and combine our knowledge with the rigour of consulting to create solutions that are innovative yet pragmatic.

We are part of JLL, a Fortune 500 financial and professional services firm. As a group, we offer an end-to-end service in delivering top-class dining destinations.

Contact Us

The JLL Foodservice Consulting team is always keen to speak to landlords, developers, architects, tenants and investors. If you have a foodservice project and are looking for strategic advice, please contact us:

Ken Higman

Ken.Higman@eu.jll.com

Ken.Higman@eu.jll.com

Director, Foodservice Consulting

Ian Hanlon

Ian.Hanlon@eu.jll.com

Ian.Hanlon@eu.jll.com

Director, Foodservice Consulting

Adam Griffin

Adam.Griffin@eu.jll.com

Adam.Griffin@eu.jll.com

Director, Foodservice Consulting

Richard Moulds

Director, Foodservice Consulting

Richard.Moulds@eu.jll.com

Richard.Moulds@eu.jll.com

Paulina Herrmann

Senior Consultant, Foodservice Consulting

Paulina.Herrmann@eu.jll.com

Paulina.Herrmann@eu.jll.com

Jll.co.uk

COPYRIGHT © JONES LANG LASALLE IP, INC. 2020

This report has been prepared solely for information purposes and does not necessarily purport to be a complete analysis of the topics discussed, which are inherently unpredictable. It has been based on sources we believe to be reliable, but we have not independently verified those sources and we do not guarantee that the information in the report is accurate or complete. Any views expressed in the report reflect our judgment at this date and are subject to change without notice. Statements that are forward-looking involve known and unknown risks and uncertainties that may cause future realities to be materially different from those implied by such forward-looking statements. Advice we give to clients in particular situations may differ from the views expressed in this report. No investment or other business decisions should be made based solely on the views expressed in this report