IFM Allocation Model for Support Services in Hospitals as a Basis for FM Driven Financing of Healthcare Real Estate

Based on European standard, BS EN 15221-4: Taxonomy of FM, this research was pursued to create a model for systematically developing FM services in hospitals, including a specification for hospital contexts and their specific accounting directives.

Vol.4, No.3 • October 2013

IFM Allocation Model for Support Services in Hospitals as a Basis for FM Driven Financing of Healthcare Real Estate

Susanne Hofer

and

Nicole Gerber

geri@zhaw.ch

Zurich University of Applied Sciences

P.O. Box, CH-8820 Waedenswil, Switzerland

Abstract

Switzerland is among the top ranked countries in terms of health expenditure as a percentage of its GDP. Since 2012, Swiss hospitals have had to comply with Diagnosis Related Groups (DRG) and thus have to be more cost oriented. Nevertheless, large investments will be necessary to replace aging hospital infrastructure (so far investments have been financed by the government, this has now been changed to a self-financing model). Two peculiarities of the Swiss hospital market are that the operators of a hospital are often the owners of the infrastructure and the providers of the services. Austerity and stronger competition are likely to lead to cost-related changes, most probably resulting in a need for hospitals to be financed in new ways (such as PPP, subsidiaries or joint ventures models). Due to the low quality of the available data and inconsistent use of FM terms, an allocation system is required prior to any investigation into new ways of financing healthcare infrastructure. In order to systematically develop FM services in hospitals, the •Allocation Model for Support Services in Hospitals• has been developed. It is mainly based on the EN 15221-4 European/Swiss norm, but also includes a to date unavailable specification for hospital contexts and their specific accounting directives. Two possibilities for new FM driven financing concepts in Swiss hospitals resulted from this piece of research: an External Supplier Concept and a Private Finance Initiative.

Introduction and Background

The Swiss system is of extraordinary quality (Achtermann & Berset, 2006, p. 17; Olmsted Teisberg, 2007), albeit very costly (OECD / WHO, 2011, p.11). Due to rising costs and austerity, politicians have decided to introduce the well-known DRG system. According to Rae (2005, p. 30) the DRG system is supposed to lift productivity within hospitals by 10 to 15 per cent. In contrast to most other countries, Swiss cantons (states) are sovereign in all matters relating to healthcare delivery. According to Kocher (2010, p. 133) •Switzerland cannot afford the costs arising from cantonal fragmentation•, but so far, no steps have been taken by the federal government to address this issue.

The building of public hospitals has until now been financed by the municipalities and cantons. Moving forward with the newly introduced DRG remuneration system, infrastructure will need to be financed by lump sums, this means that the hospitals will have to find the financing themselves (Reisebeck & Schöne, 2009, p. 188; SwissDRG, 2008; Lennerts & Abel, 2006; Hölzer, 2005; Indra, 2004). Due to the fact that up to now the cantonal authorities have been the clients of the building and construction companies, it is not surprising that hospital planning and design concepts have focused on fixed area allocations and not on cost-effectiveness. Based on of the investment backlog in Swiss hospitals, to the tune of CHF 15•20bn (Elsener, 2011), combined

with financial restrictions, hospitals will increasingly have to balance hospital planning with how they finance their infrastructure in the future. As a result, cantons will have to delegate the power to acquire new funding to hospital leaders, and the latter will have to become familiar with new ways of financing their infrastructure. Facility Management (FM) has the capacity and the power to support this aim in an extraordinary way.

In Swiss hospitals, FM services and facility management in general exhibit three particular peculiarities. Firstly, the outsourcing of FM services is not very popular and thus services are mainly provided in-house. Secondly, because there currently no commonly used FM terminology it is impossible to compare services and roles between different hospitals and impossible to create generic benchmarks. Thirdly, there is very little cost transparency in terms of the FM services provided and the management of all FM tasks. As a result, there is no standard way of handling FM cost allocation, leading to the fact that there is no fundamental financial basis for calculating KPIs, for benchmarking or for making any strategic FM decisions. Therefore, an allocation system is required before there can be any further consideration of any new methods for financing healthcare infrastructure.

IFM Allocation Model for Support Services in Hospitals

Interviews with FM managers in Swiss hospitals revealed that there is in fact a great need to define FM services and common FM terminology in hospitals, in order to be able to define processes and to logically and transparently allocate finances. Therefore, an initial literature research was conducted in order to find reference work that could be explored further. Unfortunately, neither the OPIK FM service model in the German speaking area, the National Health Service in England nor the Nordic FM model revealed a holistic approach that is flexible enough to include all the aspects that require consideration. Based on interviews conducted with norm experts, the SN EN 15211-4 European/Swiss norm turned out to be a suitable basis for further development of FM services. However, the existing version needs adjustment in order to logically represent hospital support services. This is why the IFM Allocation Model for Support Services in Hospitals was developed.

SN EN 15221-4

The scope of SN EN 15221-4 is

- •to provide taxonomy for FM which includes:

- relevant interrelationships of elements and their structures in FM;

- definitions of terms and contents to standardize facility products that provide a basis for cross border trade, data management, cost allocation and benchmarking;

- a high level classification and hierarchical coding structure for standardized facility products;

- expanding the basic FM model given in EN 15211-1 by adding a time scale in the form of the quality cycle called PDCA (Plan, Do, Check, Act);

- a linkage to existing cost and facilities structures

- alignment with primary activities requirements.

- Additional benefits of this standard are:

- introduction of a client rather than a specifically asset oriented view;

- Harmonization of different existing national structures (e.g. building cost codes) on an upper level relevant for the organisation and its primary activities.• (SN EN 15221-4:2011 (E), p. 8)

The norm defines organizations according to three top level FM categories: Space & Infrastructure (1000), People & Organisation (2000) and Central (horizontal) Function. Under each category, there are several sub-products which themselves can be divided into further sub-products. For example, if one examines the People & Organisation category (2000), Product Logistics (2400) appears as a sub-product, with a further sub-product Mobility (2440) below it, and Fleet management (2441) on another sub-level below that. EN 15221-4 allows organization specific products to be added, however, only two separate categories (1900 and 2900) are available for this purpose. It became apparent from the expert group discussions that healthcare has several additional services that need to be included in the model. However, systematically allocating these additional services to

the existing superordinate categories would mean that the services would be divided across multiple categories, resulting in a confused and illogical picture. In addition, expert discussions showed that FM is clearly perceived as a service and not as a product in hospitals resulting in the decision to consistently use the term •Services• instead of •Products•. For these reasons, it became evident, that the norm would provide a good basis for an Allocation Model for Support Services in hospitals, nevertheless, it would need a hospital specific service structure in order to meet healthcare specific requirements.

Development of IFM-Service Allocation Model for Support Services in Hospitals

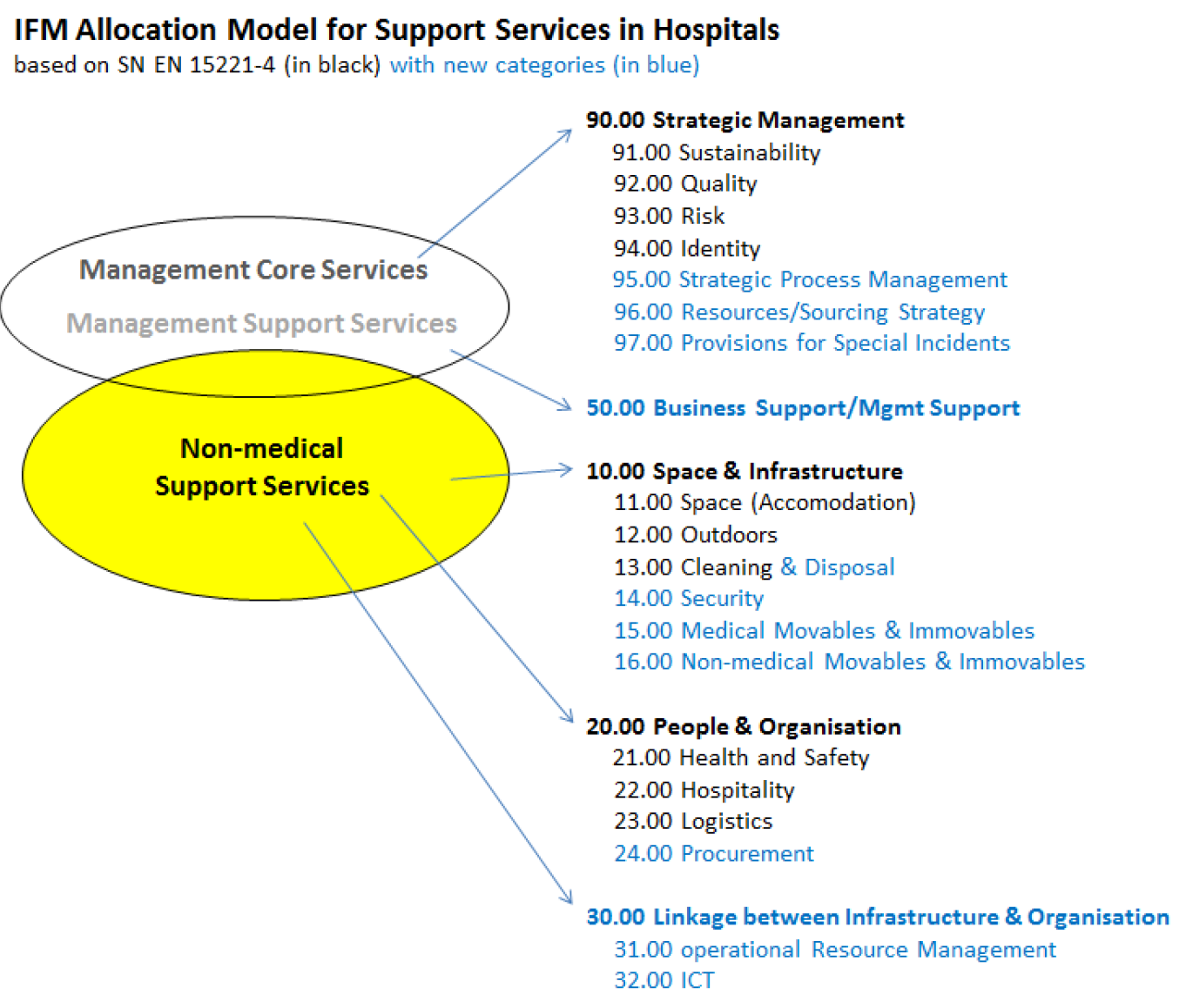

Usually three process levels are defined in classical business studies: management processes, core processes and support processes. Expert interviews quickly revealed that this classic division cannot be applied on a one-to-one basis in hospitals, since support processes and services are divided into management support, medical support and non-medical support. This led to a hospital specific model being created that divided the process levels into management core and support services, medical core and support services and non-medical support services (Figure 1).

Figure 1: Service Levels in Hospitals

In addition, expert interviews revealed that operational services that produce costs and, as a result, do not appear on the balance sheet needed to be treated differently from asset creating investments that must be included in the balance sheet. Therefore, asset and portfolio management and project management were separated from operational aspects in the model (see visualization in figure 2).

Figure 2: Cost driven Operational Services vs. Investments

Focusing on Facility Management, it was necessary to examine non-medical support services and management core and support services that impact on FM services in order to further develop the model. By combining SN EN 15221-4 with the above mentioned findings and with the results from expert interview, two major categories for •Business Support / Management Support• and •Linking Infrastructure and Organisation• were added to the

existing ones. This led to the decision to change the numbering within the new allocation model to two digit numbers with two decimal places in place of the four digit numbers in the original norm to provide clear differentiation between the original norm and the new model. Further adaptations included:

- adding Strategic Process Management (95.00), Resources and Sourcing Strategy (96.00) and Provisions for Special Incidents (97.00) to the Strategic Management Core Services category.

- adding the positions from 2500 to the new Business Support/Management Support category (50.00)

- adding Cleaning and Waste Management (13.00), Medical Movables and Facilities (15.00) and Non-medical Movables and Facilities (16.00) to the Space and Infrastructure category (10.00)

- differentiating between Security (14.00) and Safety (21.00)

- adding Procurement (24.00) to the People and Organisation category (20.00)

- adding Operational Resource Management (31.00) and ICT (32.00) sub-categories to the new Linkage between Infrastructure and Organisation category (30.00)

Figure 3 visualizes the new categories, subcategories and numbering.

Figure 3: New Categories, Subcategories and Numbering

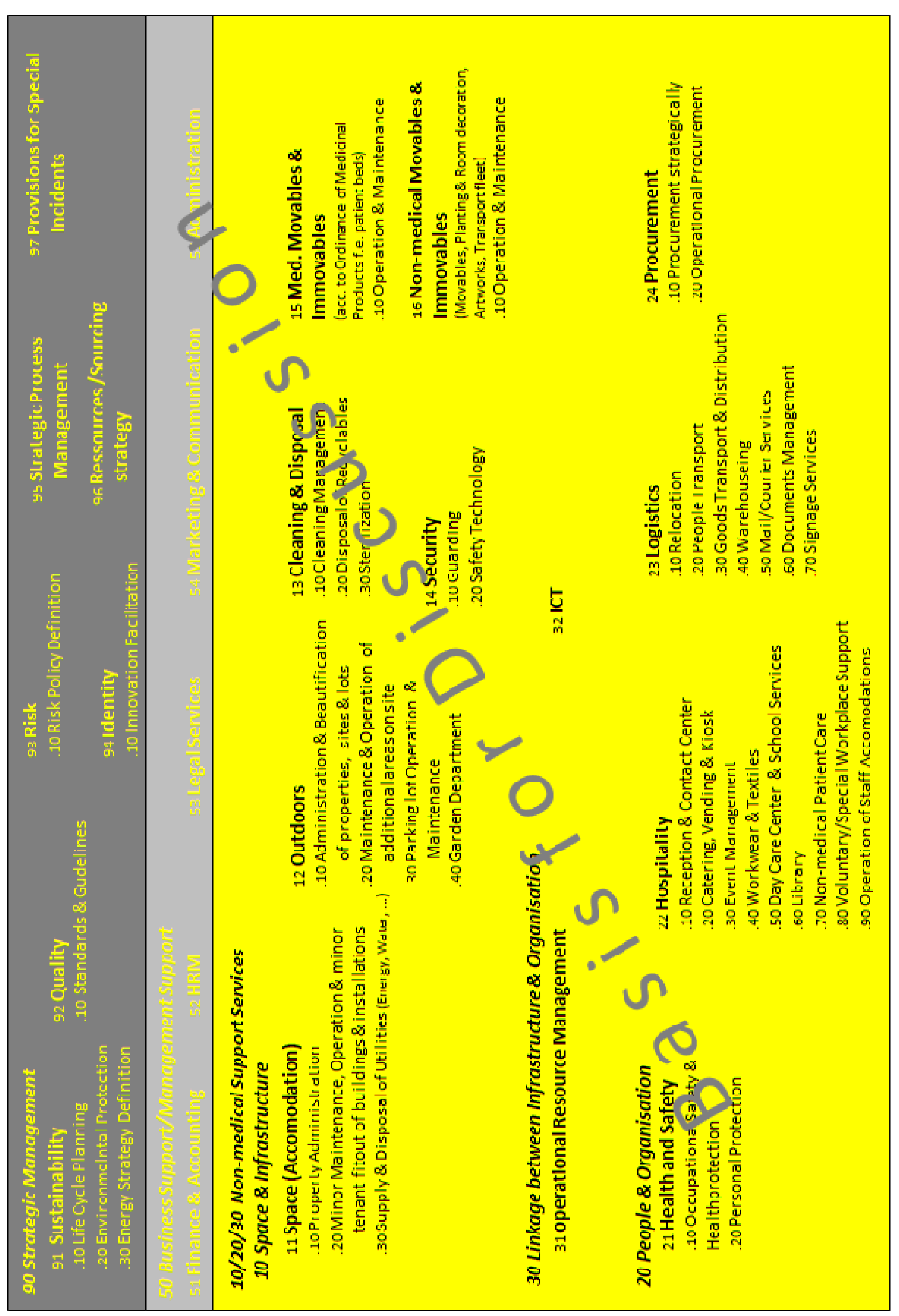

Figure 4 shows the additional service levels, resulting from the expert interviews. SN EN 15221-4 not only names the products but also describes them and defines what is included in and excluded from the specific products. Based on this concept, the IFM Service Allocation Model for Support Services in Hospitals was complemented by an extensive list of all category definitions and details of service components that are included and excluded in all the services and sub-services. If available and applicable, the definitions were taken from topic specific norms, regulations or governmental and industry recommendations. The list is currently being completed and validated.

Figure 4: Detailed Service Levels

Evaluation of FM driven concepts in financing healthcare real estate

As mentioned in the introduction, Swiss hospitals need new financing models. By having a clear definition of all FM services in hospitals, it will be possible to transparently allocate costs and calculate FM driven concepts in financing healthcare infrastructure.

External Supplier Concept

The idea of an external supplier concept is to find a service provider who will provide a hospital with the funds to construct certain parts of the hospital (e.g. a caterer who provides the investment to build or upgrade a hospital kitchen) and in return will receive a service contract for a certain amount of time.

In order to realize this concept, two different business models appear to be applicable in the Swiss market, even though some cantons still have to •decartelize• their hospitals.

- Buy-in

- Joint Venture

With the Buy-in model, the external service supplier - by providing the funds required for the development of the healthcare facility - purchases a share or •stake• in the organization. This model allows the pooling of separate investments into one large capital sum, hence individual service suppliers cooperate and can become part of an investment group.

The Joint Venture model brings together aspects of Buy-in and Joint Venture models, since it provides a framework under which all stakeholder interests can be coordinated and managed via FM throughout both, the construction and the operational phases of the new healthcare facility. The investment phase incorporates certain elements of the Buy-in model, since FM solicits investment from service suppliers. It also incorporates the FM / investor alliance element of the Joint Venture model, since FM represents the healthcare organization•s interests in the relationship between the two parties. Upon completion of the construction of any new facility, the joint venture then moves to the operational phase. With this model, services provided to the new facility will be coordinated and managed by internal FM. It is within the operational phase that the return on the investment and profit from the provision of services will be realized (Munstermann, Dmochowska, & Solati, 2013)

Based on the IFM-Service Allocation Model for Support Services in Hospitals (see above), both the hospitals and the interested service providers have a clear basis for their financial calculations and for setting up Service Level Agreements.

Operating company (OpCo) and property company (PropCo) should become a common model in the Swiss health care market

Using An OpCo/PropCo organizational structure often •leads to more efficient and less expensive financing•, enabling both companies •to borrow independently of each other and raise more finance• (Wyss, Winzap, & Bürgi, 2007, p. 1). The OpCo/PropCo structure operates by way of a sale and lease back process (Hyams, 2012, p. 14). The PropCo buys the building from the OpCo owner and leases it back to them. The companies may be independent of each other and may also be separately owned. In this type of arrangement, all the finances of both companies remain separate (Investopedia, 2013a). In the Swiss hospital market, this structure is not very common. However, such a structure could be envisaged where hospitals would be the OpCos, providing all the healthcare related services, and a consortium would be the PropCo, in charge of developing the real estate. Two scenarios are possible: In scenario one, all real estate would belong to the consortium. In scenario two, the PropCo would be split into two stakeholder sections: the consortium and the hospital.

In this structure, the PropCo would hold all the assets necessary to secure mortgage loans and would borrow money from lenders. The hospital (OpCo), as the operator, needs the property held by the PropCo to run its operations, therefore a long-term lease agreement would be set up between the two entities. The PropCo would then use its rental income to service its loans (Hyams, 2012, p. 14; Wyss, Winzap, & Bürgi, 2007). Such a structure allows borrowing to be increased. For the hospital, however, selling the real estate to the PropCo does not mean its capacity to borrow is reduced, since lenders usually look at its ability to service its debts. This is in contrast with the PropCo•s lenders •who usually look at PropCo•s loan to value ratio• (Hyams, 2012, p. 14).

Even though the OpCo and PropCo are legally separated, the OpCo•s risks in financial terms remain similar to those for the PropCo. This is especially true •when there is no liquid market for the assets• (Wyss, Winzap, & A Bürgi, 2007, p. 1), as is the case for hospital buildings in Switzerland; hospital buildings can only be used for healthcare purposes, therefore any application for a change of use would be very costly. This is why it is important to mitigate the risks by calculating and maintaining a realistic rent for the OpCo, despite the fact that shareholders are typically interested in maximizing their return. This is because demands for increased rental returns could threaten the existence of the OpCo (Hyams, 2012).

The advantage of separating the company is obvious, since ring-fencing of the assets from the rest of the business (allowed under Swiss law) limits the risks to all shareholders. As a consequence, using securitization to refinance loans should become easier and more cost efficient. The lower the risk for the lenders, the more efficiently any refinancing can be structured. (Wyss, Winzap, & Bürgi, 2007, p. 1)

The lease agreement is a key element of this structure. Such agreements are long-term and form a significant part of the PropCo•s income. Predicting the cash flow generated by the assets is essential and therefore the predictability of the cash flow will also influence the agreement. The contract duration, the ability to terminate and the indexation of rent paid must also be analyzed. Under Swiss law, lease agreements can be for an indefinite period or for a fixed term. From the perspective of financing and refinancing real estate, it is advisable to set up an agreement for a fixed term, since this type of lease agreement can only be terminated for valid reasons, whereas an indefinite lease agreement can be terminated simply by giving notice. Increasing the rent is only permitted by indexing the rent to the Swiss Consumer Price Index to cover inflation, and is only possible if the agreement has a duration of more than five years. (Wyss, Winzap, & Bürgi, 2007, p. 4). According to Hyams (2012, p. 16), Opco/PropCo structures prosper if the lending market is stable and financial crises do not cause a lack of available credit.

Private Finance Initiative

Private Finance Initiatives (PFI), also known as Public Private Partnerships (PPP) are long-term agreements between the public and private sectors, in which private sector capacity and public sector resources are used in order to deliver public sector infrastructure and/or services according to a specification defined by the public sector (Barlow, Roehrich, & Wright, 2010). A hospital, regarded as a public sector entity, irrespective of its legal form, signs a contract with a private sector consortium (Boussabaine, 2007; Hughes & Gruneberg, 2006). PFI consortiums are owned by a number of private sector investors, most probably including a construction company, service providers, an institutional investor and/or a bank. The aim of the consortium is to provide the hospital with an asset and the services related to this asset. Furthermore, the consortium is in charge of maintenance and capital replacement over the period of the contract. (Hughes & Gruneberg, 2006) Projects delivered under the PFI system are very complex and they require a major financial outlay. Therefore, they are rarely financed and delivered in their entirety by a single provider. Input from the members of the consortium is managed through a special purpose company, which is a separate legal entity from the individual member organisations. Authorities encourage construction companies to work in teams, in order to form a consortium, and have, in the past, involved private sector finance in the funding process (PFI). In response, and only after having won a bid, Special Purpose Vehicles (SPVs) are set up. The structure of the SPV is dictated by tax and legal considerations, as well as by the credit worthiness of each member. (Hughes & Gruneberg, 2006, p. 4).

The reasons for having more than one sponsor are as follows:

- financial, including tax considerations and if the technical requirements exceed the capacity of the sponsor

- risk sharing

- sponsor capabilities are complementary

- •bankruptcy remoteness, that is to prevent the project from a potential bankruptcy of any of the providers• (Boussabaine, 2007, p. 90).

There are different reasons for working in a consortium, but there are also different interests involved, some of which are diametrically opposed to each other. A number of firms combine to negotiate with the client, but these firms do not necessarily have close working relationships with the other members of the consortium. Nevertheless, the consortium presents itself as a unified group to the client in order to win the tender process, although the arrangements between the consortium members remain informal. (Hughes & Gruneberg, 2006) PFI contracts can be looked at from two perspectives. Firstly, the contract between the hospital and the consortium and secondly, the contracts between members in the consortium and other parties that will provide additional services to the individual members of the consortium (Munstermann, Dmochowska, & Solati, 2013).

Methodology

Expert interviews with norm experts were conducted and the SN EN 15221-4 norm was evaluated. The information resulting from this process was then used as a basis for interviews with FM experts. The data was gathered using semi-standardized guideline-based individual interviews with FM experts in four different hospitals. The findings were then applied to the original norm structure, resulting in the Service Allocation Model for Support Services in Hospitals. The newly set up model was then discussed and refined with norm experts. Hospital FM experts were then once again consulted in group expert interviews resulting in a further adaptation of the model.

In order to research implications for healthcare infrastructure funding, heads of hospital FM were asked in an initial survey if the quality of the data currently available to them was perceived as sufficient to economically and sustainably develop and execute infrastructure funding initiatives at both strategic and operational levels. In parallel, cantonal ministries were asked about hospitals• freedom of action with respect to financial initiatives, such as lending money or cooperating with third parties (Hofer, 2013). In addition, the hospital heads of FM were asked if the available data and its quality were sufficient to operate successfully under DRG (Hofer, 2013). A separate literature review evaluating financial models used in other fields and countries was also conducted. During the evaluation of different possibilities, the potential suitability of the external supplier and the OpCo/PropCo concepts became apparent.

Conclusions

It is our opinion that The IFM Service Allocation Model for Support Services in Hospitals provides a good basis for future work for the following reasons:

- it provides a common understanding of FM services and facility management in hospitals

- it offers a transparent way of allocating costs and is thus necessary for generating KPIs & benchmarking

- it establishes clear and comparable FM processes in hospitals in order to enhance effectiveness, efficiency and transparency

- it opens up the possibility of developing FM driven funding of healthcare real estate

Research into FM driven financing concepts revealed two possibilities for Swiss hospitals: the External Supplier Concept and the Private Finance Initiative. Both possibilities aim to support hospital financial initiatives using concepts that are not reliant on traditional methods of money lending, which are for the most part no longer feasible for hospitals due to a lack of equity.

Outlook

The IFM Service Allocation Model for Support Services in Hospitals was developed using a qualitative approach. It will, however, be necessary to perform further in-depth validation of the model. This will be done by convening several additional expert groups and carrying out a subsequent quantitative survey. How far the findings can be incorporated into further developments of EN 15221-4 will have to be discussed with the (Swiss) Standards Norm Association.

New FM driven financing concepts will have to be discussed in depth with hospital leaders and cantonal authorities in the near future. The expert commission for Swiss hospital accounting standards (REKOLE®) will be consulted to formalize a standard for cost allocation practices.

Acknowledgements

Proofreading: Darren Mace.

References:

Achtermann, W., & Berset, C. (2006). Gesundheitspolitiken in der Schweiz. Potential für eine nationale Gesundheitspolitik, Analyse und Perspektiven Band 1. Bern, Switzerland: BAG, Geschäftsstelle des Bundes für Nationale Gesundheitspolitik Schweiz.

Barlow, J., Roehrich, J. K., & Wright, S. (2010). De facto privatization or a renewed role for the EU? Paying for Europe•s healthcare infrastructure in a recession. Journal of the Royal Society of Medicine , 51-55

Boussabaine, A. (2007). Cost Planning of PFI and PPP Building Projects. Abingdon, Oxon, UK: Taylor & Francis.

Elsener, C. (2011). Finanzierung von Spitalimmobilien: Am Puls der Investitionskosten. Bern: PricewaterhouseCoopers AG.

Hölzer, S. (2005, July 29). Fallpauschalen sollen einheitlich sein. Handelszeitung. Retrieved from http://www.handelszeitung.ch/unternehmen/verguetungssysteme-fallpauschalen-sollen-einheitlich-sein

Hofer, S. (2013). FM in Swiss Hospitals. [Unpublished Manuscript]. Institute for Facility Management ZHAW, Zurich Switzerland.

Hughes, W., & Gruneberg, S. (2006). Understanding construction consortia: theory, practice and opinions. RICS Research paper series , 6 (2).

Hyams, J. (2012). Opco/Propcos - structurally unsound? Real Estate Quarterly (Summer issue), 14-17.

Indra, P. (2004). Die Einführung SwissDRGs in Schweizer Spitälern und ihre Auswirkung auf das schweizerische Gesundheitswesen. Schriftreihe SGGP. Bern, Switzerland: SGGP.

Investopedia. (2013a). Operating Company/Property Company Deal - Opco/Propco Deal. Retrieved from http://www.investopedia.com/terms/o/opco-propco.asp

Kocher, G. (2010). Kompetenz- und Aufgabenteilung Bund • Kanton • Gemeinden. In G. Kocher & W. Oggier (Eds.), Gesundheitswesen Schweiz 2010-2012. Eine aktuelle Übersicht (4th ed.). (pp. 133-149). Bern, Switzerland: Hans Huber Verlag.

Lennerts, K., & Abel, J. (2006). Win-Win für FM und Gesundheitswesen • neue Sichtweise: Immobilie als Betriebsmittel. Management & Krankenhaus, 3, 14.

Munstermann, L. Dmochowska, W. & Solati, N. 2013. Private Finance Initiative in Healthcare. [Unpublished case study thesis]. Institute for Facility Management ZHAW, Zurich Switzerland.

OECD / WHO. (2011). Reviews of health systems: Switzerland 2011. OECD. doi: 10.1787/9789264120914-en

Olmsted Teisberg, E. (2007) Opportunities for Value-Based Competition, Swiss Healthcare. Zurich, Basel, Bern, Switzerland: Economiesuisse, Hirslanden, Interpharma, Swiss Insurance Association, Swisscom IT. Rae. D. (2005) Getting Netter Value for Money from Sweden's Healthcare system. Working papers in OECD/WKP(2005)30. Paris, France: OECD.

Reisebeck, T., & Schöne, L.B. (2009). Immobilien-Benchmarking. Ziele nutzen, Methoden und Praxis (2nd ed.). Heidelberg, Germany: Springer Verlag.

SwissDRG. (2008). Fallpauschalen in Schweizer Spitälern. Basisinformationen für Gesundheitsfachleute. (Fact sheet). Retrieved from http://www.swissdrg.org/de/07_casemix_office/InformationenZuSwissDRG.asp?navid=6 view.html

Wyss, L., Winzap, M. & A Bürgi, J. (2007, December 4). Opco/Propco Structures under Swiss Law. Securitisation & Structured Finance - Switzerland . Switzerland: Globe Business Publishing Ltd.

Want even more Content?

Since you’re already a user, you know that IFMA’s Knowledge Library offers all FM content in one place. But did you also know that by signing up via email to become a registered user, you can unlock even more resources?

Signing up via email for registered access within the Knowledge Library brings more content and functionality to your fingertips. Expect to grow your facility management knowledge, career and network faster than ever before.